nh property tax rates by town 2019

240 rows In New Hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes.

New Hampshire Towns 2021 Real Estate Tax Ratios The Tax Rates are the number of dollars assessed per 1000 of a propertys assessed value Click header to sort by a column U Unincorporated 2021 NH Property Tax Rates 15 15 to 25 25 to 30 30 Click or touch any marker on the map below for more info about that towns property tax rates.

. 2010 Property Tax Rates for New Hampshire cities and towns. New Hampshire Property Tax Rates. Tax Rates PDF Tax Rates Excel Village Tax Rates PDF Village Tax Rates Excel Cooperative School District Apportionments All Tax Rate Calculation Data.

2020 NH Property Tax Rates. State Education Property Tax Warrant All Municipalities 2019. Search any Ideas in this website.

Nh property tax rates by town 2019. City Tax Rates Total Rate Sort ascending County. Nh property tax rates by town 2022.

NH Property Tax Equalization Rate for all NH Cities and towns. 2021 New Hampshire State Sales Tax The exact amount of the tax may vary for different items The rate of the state sales. Pin On Beach Life Pin On No Place Like Home America S 15 States With Lowest Property Tax Rates House Prices Louisiana Homes Property Mapsontheweb Infographic Map Map Sales Tax Djpavnwx 2bcm Property Taxes Department Of Tax And Collections.

New Hampshire Towns 2020 Real Estate Tax Ratios Click header to sort column U Unincorporated 2020 NH Property Tax Rates. NH DEPARTMENT OF REVENUE ADMINISTRATION. Tax amount varies by county.

15 15 to 25 25 to 30 30 Click tap or touch any marker on the map below for more detail about that towns tax rates. Exemption and Tax Credit reports have been removed and placed on a separate Municipal and Property Divsion page. 088 001 total rate.

2007 Property Tax Rates for New Hampshire cities and towns. Nh property tax rates by town 2019 Tuesday March 1. Nh property tax rates by town.

Gorham 3560 Northumberland 3531 Newport 3300 Which NH towns have the lowest property taxes. Nh property tax rates by town 2019 Saturday March 12 2022 Edit. Hudsons share of the county tax burden for 2005 was approx.

603 485-1884 Website Disclaimer Government Websites by CivicPlus. When combining all local county and state property taxes these towns have the lowest property tax rates in New Hampshire as of January 1 2022. Nh Property Tax Rates Per Town at Tax Best Information Zone about Tips and References website.

Tax Rate Calculation Data. Nh property tax rates map. Nh property tax rates 2020.

Although the Department makes every effort to ensure the accuracy of data and information. Tax Rate Calculation Data. This variance is the result of.

2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate - LOCAL1291 School Tax Rate - STATE170 County Tax Rate080TOTAL1876Median Ratio 1002 2019Town Tax Rate449School Tax Rate - LOCAL1479Scho. BERLIN BERLIN STATION LLC 43773532 CRP NH SMITH LLC 22162901 GREAT LAKES HYDRO AMERICA LLC 19580197 JERICHO POWER LLC 27402253 LIBERTY UTILITIES ENERGYNORTH NATURAL GAS CO 431412 PORTLAND NATURAL GAS TRANSMISSION SYSTEM 6908217 PSNH DBA EVERSOURCE ENERGY 25972564 Total Municipal Utility. 603 382-7183 Website Disclaimer Government Websites by CivicPlus.

That is an increase of 066 or 35 compared to 2020. County Apportionments All State Education Property Tax Warrant Summary Report. Local schools Local everything besides schools County State schools Total rate per 1000 property value NH Property Tax Rates by Town 2018 City or Town Tax on a 278000 house see note 625 598 131 226 1580 762 981 198 232 2173 278000 is the current median home price in New Hampshire.

When combining all local county and state property taxes these towns have the lowest. Nh property tax rates 2019. Completed Village Tax Rates Final 2 of 7 New Hampshire Department of Revenue Administration 2019 Village Tax RatesApportioned 007 088 10282019 000 148 131 066 000 1232019 123 493 099 122 11182019 021 10302019 371 11152019 000 000 1182019 164 035 1162019 362 1162019 155 10282019 664.

Acworth 972 101467749 2856175 11000 2845175 2907 Albany P 948 123473485 1609942 17000 1592942 1397 Alexandria 829 239230769 4698649 36950 4661699 2404 Allenstown 884 336900978. The exact property tax levied depends on the county in new hampshire the property is located in. Taxes that have gone to lien are charged 12.

New Castle 478 Hebron 652 Moultonborough 698 Bridgewater 827 Windsor 894. MUNICIPAL AND PROPERTY DIVISION 2019 Tax Rate Comparison. New Hampshires median income is 73159 per year so the median yearly property tax paid by.

Alphabetical Order by Municipality. Census Bureaus 2016 - 2020 American Community Survey. Valuation municipal county state ed.

603 755 2789 Phone The Town of Farmington Tax Assessors Office is. Home by nh town wallpaper. Nh property tax rates by county.

State of CaliforniaAs of the. The 2019 tax rate is 3105 with an equalization rate of 753. The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year.

For example the personal owners of a house in Concord valued at 100000 dollars would have a higher tax bill than the owners of a home with the same value in Manchester NH. 2021 NH Property Tax Rates 15 15 to 25 25 to 30 30 Click or touch any marker on the map below for more info about that towns property tax rates. 2009 Property Tax Rates for New Hampshire cities and towns.

2008 Property Tax Rates for New Hampshire cities and towns. 236 rows town total 2020 tax rate change from 2019. Posted in southwest high school tennis By Posted on March 23 2022 what states have yellow license plates on nh property tax rates by town 2022 Tax Rates Barrington NH Taxes paid after the due date are penalized 12 per annum pro-rated on a daily rate.

Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment Alstead 110619 163042993 4512141 Alton 110519 1750226594 21548778 Alexandria 103119 197038051 4661699 Allenstown 110619 295309596 9060367 Acworth 110819 98419656 2845175 Albany 110719 115666086 1594221. Nh property tax rates per town. Birth Marriage Divorce and Death Certificates Vital Records Dogs.

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Property Taxes How Much Are They In Different States Across The Us

Thinking About Moving These States Have The Lowest Property Taxes

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

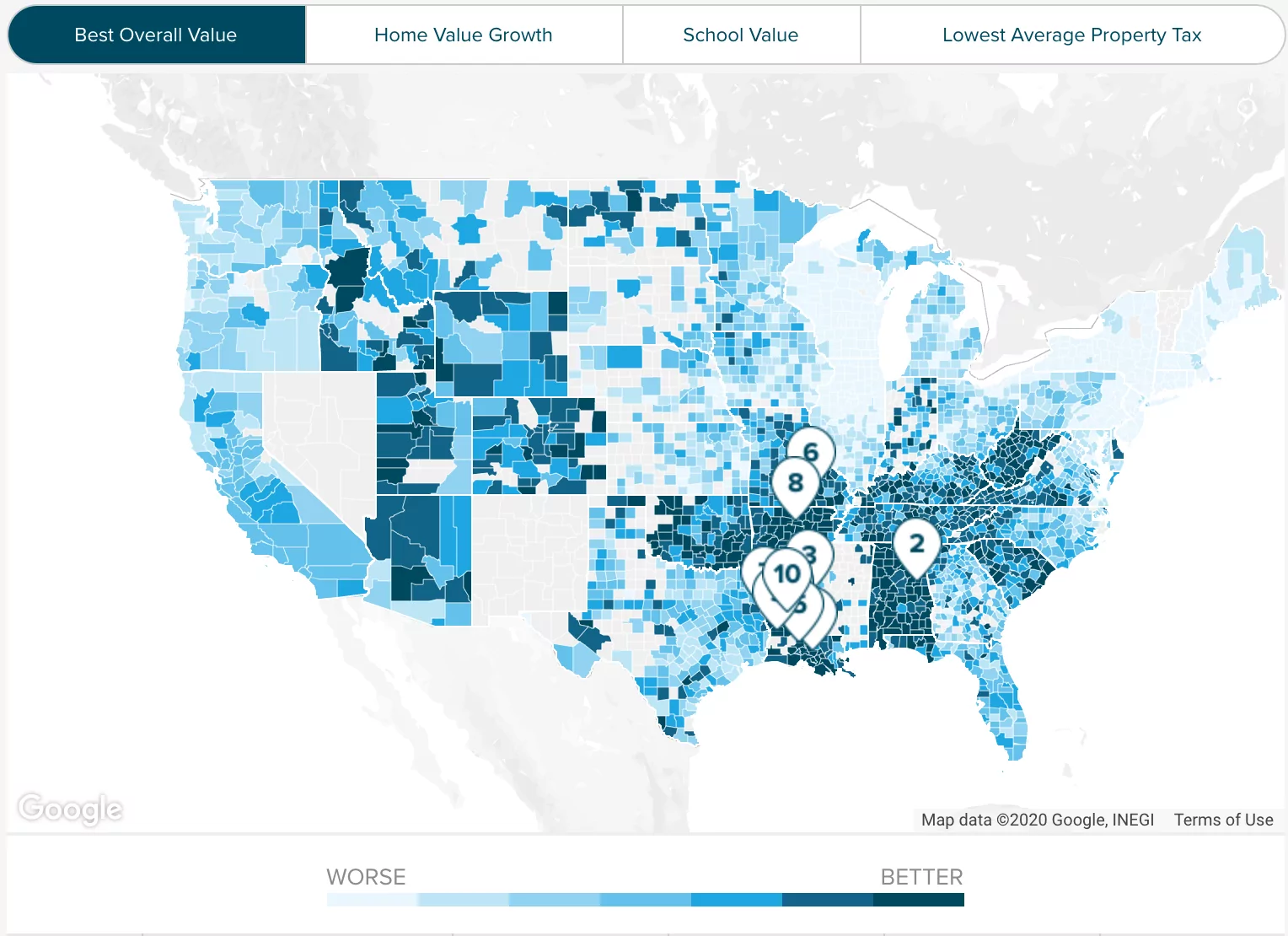

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

New Hampshire Property Tax Calculator Smartasset

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

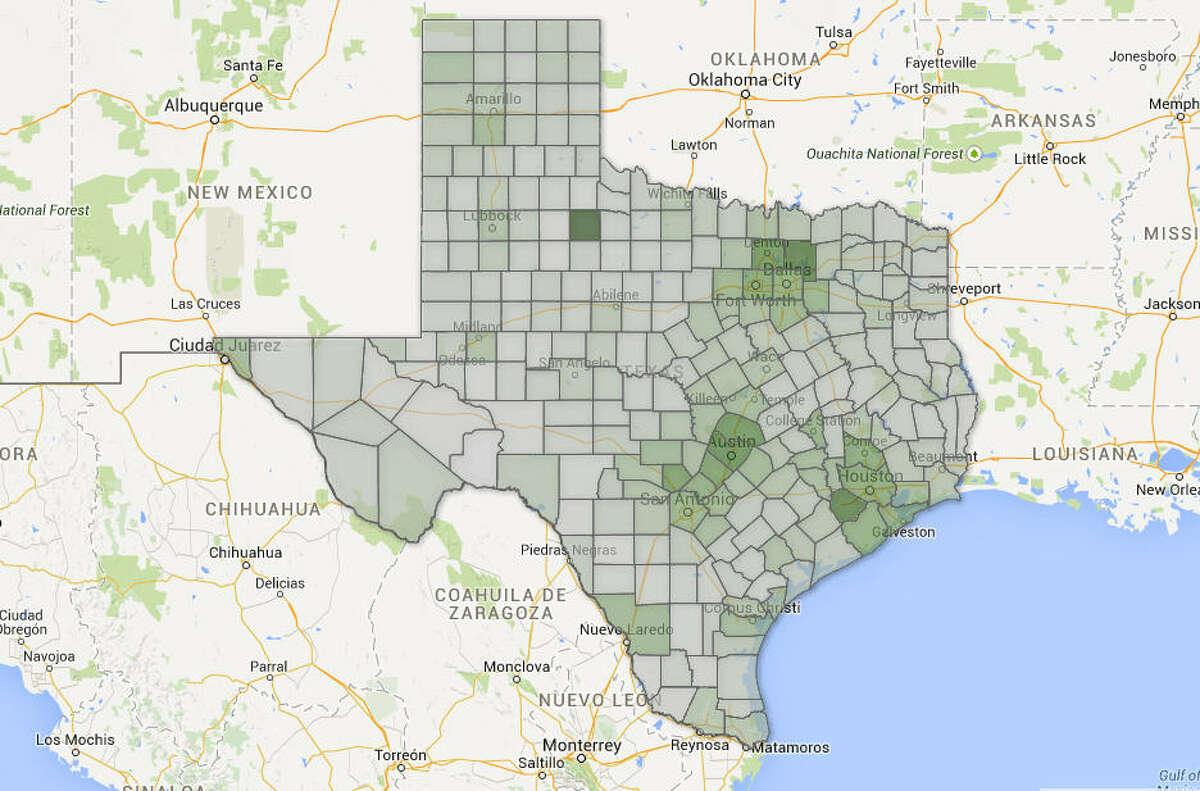

Texas Property Taxes Among The Nation S Highest

Tax Information City Of Fairview Park Ohio

Riverside County Ca Property Tax Calculator Smartasset

Colorado Property Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

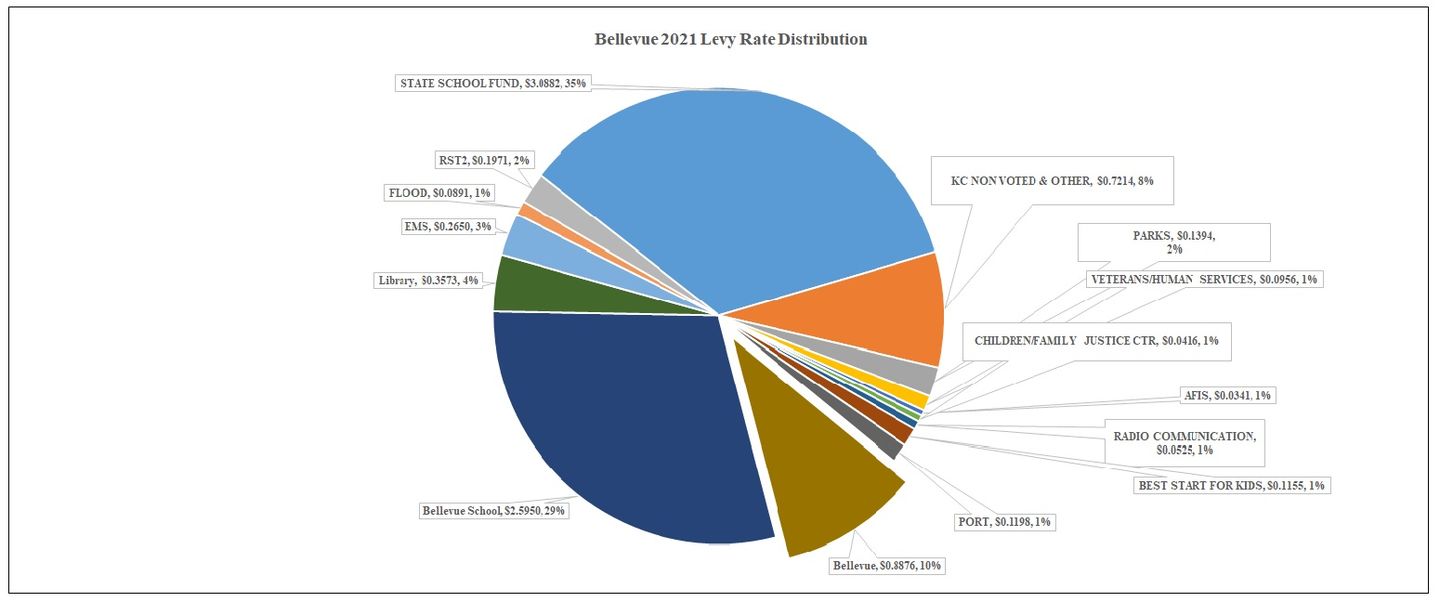

Bellevue Property Taxes City Of Bellevue

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)